“My property taxes were lower where I used to live even though my house was more expensive.”

Perhaps you’ve heard this gripe from recent arrivals in Okotoks, lamenting the fact that taxes on a $600,000 home here can be as much or more than a $1-million place elsewhere.

Ahh, the complex and often-maddening relationship between house values and property taxes.

It's a widely-held belief that the more a house costs, the higher property taxes it will pay. That’s true if you’re comparing houses within the same community, but all bets are off when you try to do so with other locales.

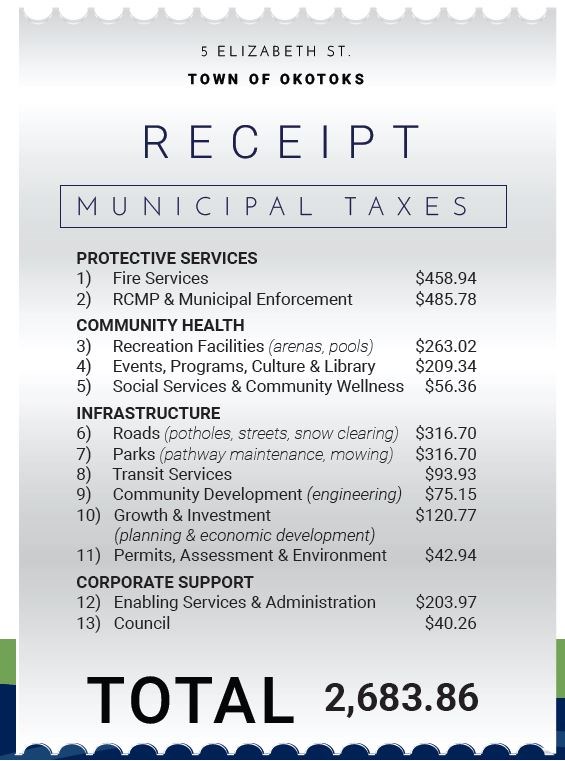

Property taxes are essentially fees for service, paying for things such as police and fire protection, roads, and parks and recreation. How much homes cost in a particular town isn’t really a factor when it comes to the provision of these services.

Okotoks and Lloydminster are almost identical in population so it would stand to reason it would take roughly the same amount of tax money to operate both towns. Lloydminster likely has a similar number of police officers, a comparable number of parks in which to cut the grass and roads to clear the snow, so their costs, and the number of homes to pay them, would be roughly equal to that of Okotoks.

That means the average home in Lloydminster would pay approximately the same in property taxes as the average home in Okotoks, yet the average home in Lloydminster is a good $200,000 cheaper than it is here.

If they’re paying the same in taxes yet their house is worth considerably less, aren't they getting ripped off? Not if they’re receiving the same services.

Head west to Penticton, a city in B.C.’s south Okanagan, or to Parksville, just north of Nanaimo on Vancouver Island, both of which are comparable in size to Okotoks but whose average house prices flirt with $1 million.

Like the Lloydminster example, these cities probably expend a similar amount to Okotoks to provide municipal services, so tax levels would also be comparable. If their houses are worth a million bucks but their property taxes are equivalent to a $600,000 or even a $400,000 home in Alberta, aren’t they getting a better deal? Not really because they’re paying the same amount as their Alberta counterparts for the same services.

Perhaps I’m oversimplifying things, but what I’m trying to get across is that comparing property tax rates using only house prices is a bit like comparing apples to oranges. Comparing taxes on an average home in one area with an average home in another, regardless of their actual values, is a much better indicator of the value you’re getting for your tax dollar.

On that front, the City of Calgary recently released its annual property tax survey, which compared rates in the Stampede City with those in cities across the country as well as all jurisdictions in the region. It found that tax levels in Okotoks are higher than some neighbouring areas but lower than others, landing in the middle in most calculations.

I suspect that still won’t satisfy those who are of the mind that their property taxes are too high.